Insights

August 4, 2025

Tariff shock for Switzerland

PERSPECTIVES Memo | Authors: Dr. Ulrich Stephan Chief Investment Officer Germany Dr. Dirk Steffen Chief Investment Officer EMEA Michael Blumenroth Senior Investment Strategist Elena Ahonen Investment Strategist

Key takeaways

–Switzerland is among the countries that received a new “reciprocal” tariff rate by the US administration in an executive order. Swiss exports to the US will be subject to a baseline tariff of 39% from August 7 onwards, up from 10% currently.

–The Swiss stock markets initially experienced a noticeable setback on Monday, but this quickly leveled off. The CHF also depreciated only moderately.

–Financial markets are currently pricing in the possibility that the Swiss government can still strike a deal. We are neutral on the SMI stock index, but the CHF could depreciate slightly.

What happened?

Switzerland is among the countries that received a new “reciprocal” tariff rate in the announcement by the US administration in an executive order released the evening of July 31 – just a few hours before the Swiss National Day on 1 August. According to the announcement, Swiss exports to the US will be subject to a baseline tariff of 39% from August 7 onwards, up from 10% currently. The executive order of US President Donald Trump is not entirely clear, but most analysts believe that for now, however, both precious metals and pharmaceutical goods continue to be exempt from tariffs, the latter pending an ongoing Section 232 investigation.

Pharmaceutical goods account for more than a third of Swiss exports to the US, gold for appr. 20%. The 39% reciprocal US tariff rate on Swiss goods is well above the 10% that was in place, and higher than both the 31% threatened in April and what the government in Berne was expecting. Swiss officials have signaled their willingness to engage in further talks before the August 7 implementation date. Swiss president and Finance Minister Karin Keller-Sutter convened an emergency meeting of the governing Federal Council on Monday to discuss how to proceed.

What does it mean for investors?

On the stock market (closed due to the Swiss National Day on Friday), the SMI fell Monday as much as 1.9% and recovered to just -0.4% by midday. Since the signing of the Executive Order, the Swiss franc has depreciated by approximately 0.8% against the euro, to approximately 0.936. The CHF has since lost 0.5% against the USD. Thus, no dramatic currency losses. There is clearly hope that Trump's announcements will now lead to further talks, ultimately resulting in a significantly lower tariff. However, US Trade Representative Jamieson Greer, at least officially, did not share this optimism. In a TV interview on Sunday, he said that the tariffs were as good as final and that he did not believe there would be new negotiations in the coming days. In the end, however, US President Trump will continue to have the final say. Let us consider the impact of the tariff announcement on the Swiss franc, Swiss stocks, and the Swiss economy.

Economics:

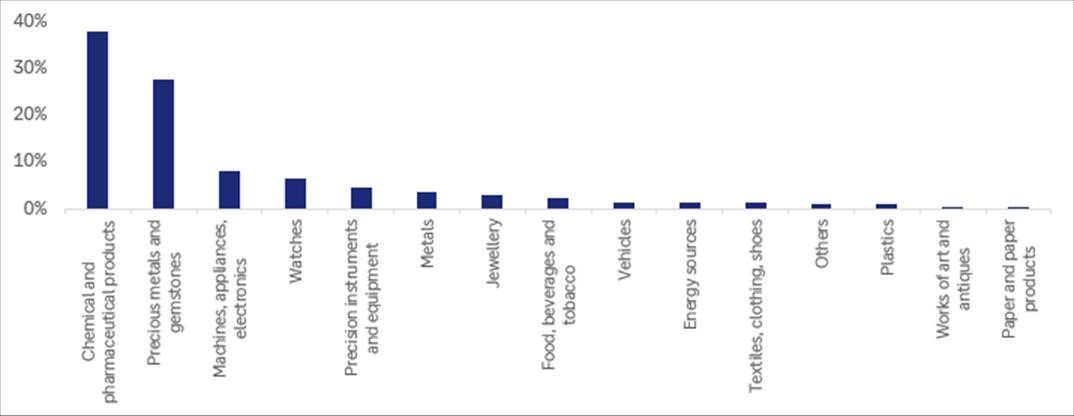

While Swiss exports to the US collapsed after the introduction of tariffs in April, they rebounded in June, suggesting that trade between the two countries remained robust. Whilst the EU is Switzerland’s most significant trading partner, US exports were covering 18.6% of the total exports in 2024. The share of exports of total GDP was a notable 72.2% in 2024, their importance to the economy having grown over time. A significant portion of these exports consists of precious metals that are cast into tradable form in Switzerland and subsequently exported. Thus, these exports are offset by corresponding imports of the raw material. Switzerland’s largest export group, chemical and pharmaceutical products at 37.8% of the total goods, has been exempt from the tariffs. Similarly, gold exports to the US have been exempt from a tariff rate. Precious metals and gemstones, including gold, was Switzerland’s second largest export group at 27.7% of total exported goods in 2024.

Stock Markets:

As markets opened for the first time after the tariff news on Monday, the Swiss Market Index (SMI) sank 1.9% in Zurich. Pharmaceutical companies, which account around 36% of index market cap, plummeted. Although the Swiss pharmaceutical exports were exempted from the reciprocal tariffs for now, several of the pharmaceutical producers received the letters that the US president Donald Trump sent to 17 major pharmaceutical companies last Friday. The letters outlined steps the producers must take to lower the price of the US prescription drugs. Though, it is debated whether the US president has the power to demand lower prices, this move has increased the pressure for the already struggling sector. In the past, the US threatened the sector with 200% tariffs and is currently investigating the possibility of imposing tariffs on imported pharmaceuticals under section 232. It is still uncertain whether the tariffs will be announced, and what their magnitude will be. A couple of months ago, a few pharmaceutical companies have announced their plans on investing into the US. For the time being the uncertainty overhang remains significant for the sector. The three largest members of the index account 45% of the market cap, and its revenue exposure to the US is significant.

The second largest sector of the index after the pharma sector is financials, which has a very limited exposure to the tariffs and remains one of our favourite sectors in Europe. The third largest group of the index according to its weight is food, beverages and tobacco, which account around 14% of the market cap. The sector has typically very low operating margins and thus can be vulnerable to any price increases.

CHF:

Considering that the 39% tariff rate came very unexpectedly, the CHF is holding up very well. Despite a seemingly unfavourable external environment, the Swiss Franc had exhibited surprising strength during the last weeks already. Global equities are near all-time highs, so that the need for "safe havens" recently appeared to be diminishing. German bund yields have risen, while the yields on Swiss government bonds with maturities of up to 5 years are negative. And implied vol in the FX space is generally still low amid a broadly carry-friendly environment. Under these circumstances, one would have expected the CHF to be weaker. At least the inflation data for July appear to have somewhat alleviated the SNB's deflation concerns for the time being. The headline and core inflation rates, at +0.2% and +0.8%, were 0.1 and 0.2 percentage points higher than the previous month and forecasts, respectively. Overnight index swaps currently price in a probability of approximately 50% for a further SNB interest rate cut by the end of the year.

Incidentally, the SNB is currently likely to refrain from intervening in the currency markets to the detriment of the CHF, so as not to be further branded as a "currency manipulator" by the US. Despite the risks arising from the tariffs, we do not currently anticipate significant pressure on the CHF but rather maintain our view of a slight depreciation against the euro in the coming months.

Figure 1: Swiss foreign trade in product groups, % of total exports in goods in 2024

Further links on the topic

Scarica il documento in pdf

I documenti in lingua inglese sono rivolti esclusivamente ai clienti in possesso delle competenze necessarie. Il presente materiale viene divulgato unicamente a scopo informativo e non deve essere interpretato come un’offerta, una raccomandazione o un invito all’acquisto o alla vendita di investimenti, titoli, strumenti finanziari o altri prodotti specifici, per la conclusione di una transazione o la fornitura di servizi di investimento o di consulenza sugli investimenti o per la fornitura di ricerche in materia di investimenti o raccomandazioni in merito agli investimenti, in qualsiasi giurisdizione. Per maggiori informazioni si prega di leggere la sezione ”Informazioni importanti” presente nel del report completo scaricabile dal link di cui sopra.

Torna alla pagina Insights